Auto Risk Manager (NBFO)

About ARM

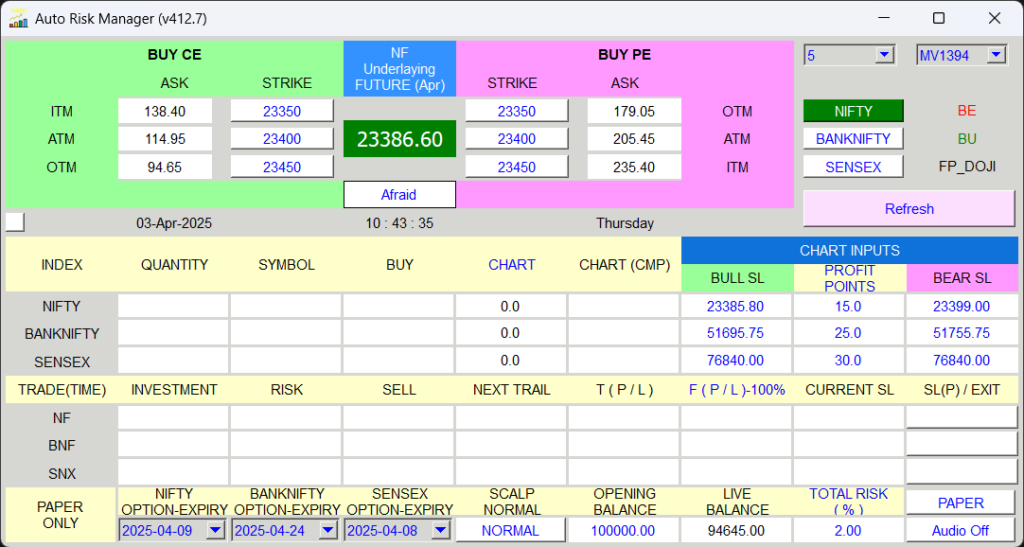

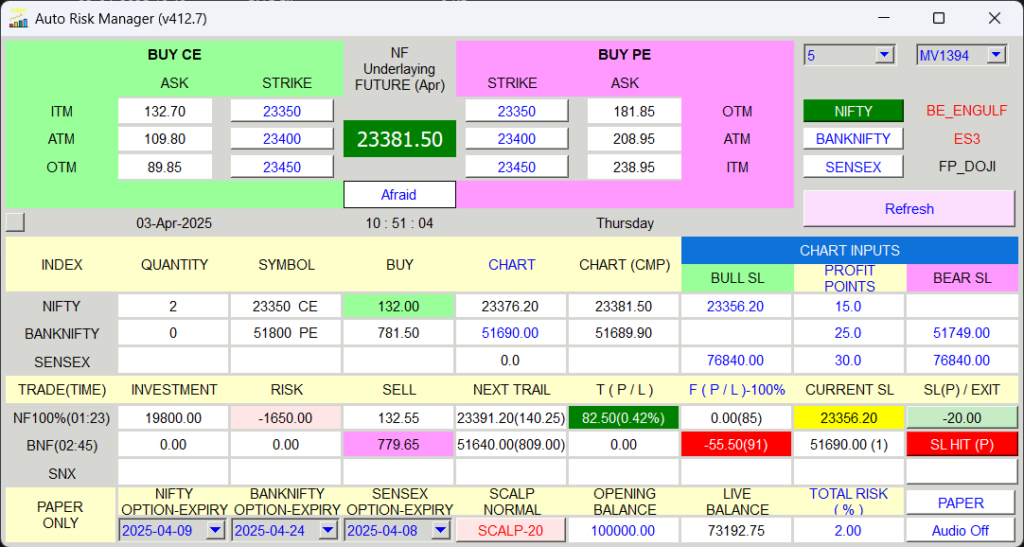

- Auto Risk Manager Software (ARM) is designed for trading in the Stock Market, specifically for Trading Options in NIFTY, BANKNIFTY & SENSEX.

- It offers Real & Paper Trading Mode.

- With ARM, users can take Position and Square-off order at their will.

- ARM takes care of Discipline, Patience, avoid trader becoming Greedy & Fearful.

- ARM genrates Trade Log file for further analysis during every Login Seassion.

- ARM Calculates Quantity based on Risk & Money Management principles.

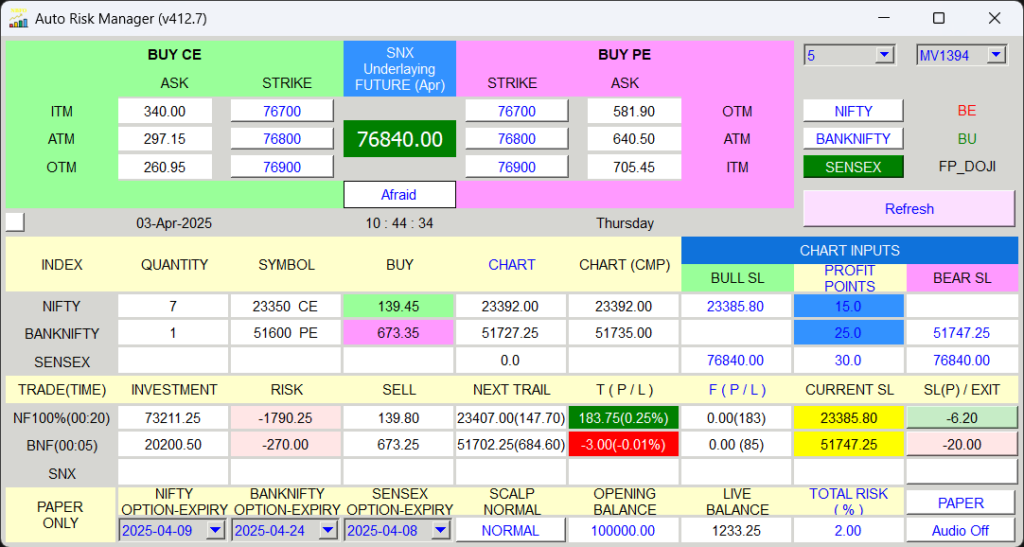

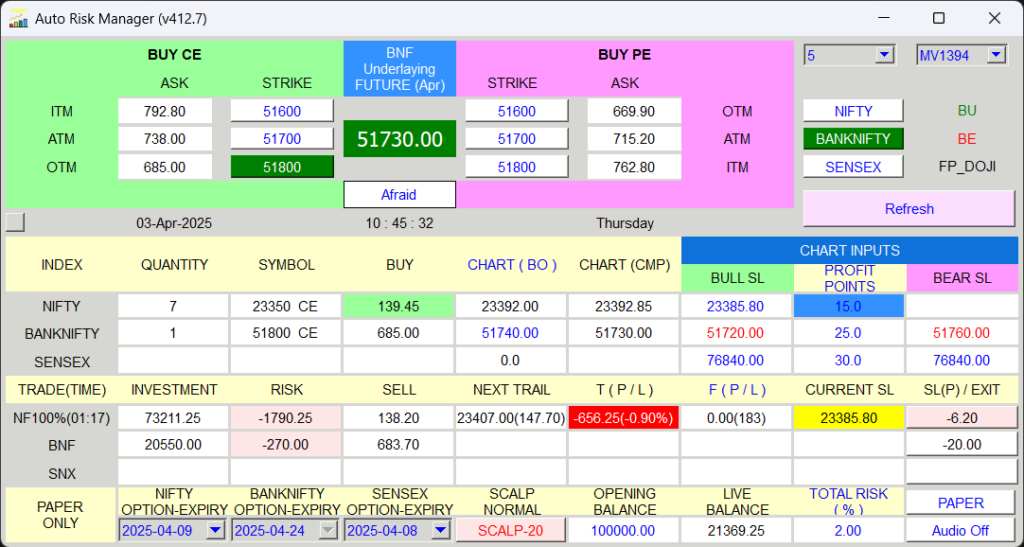

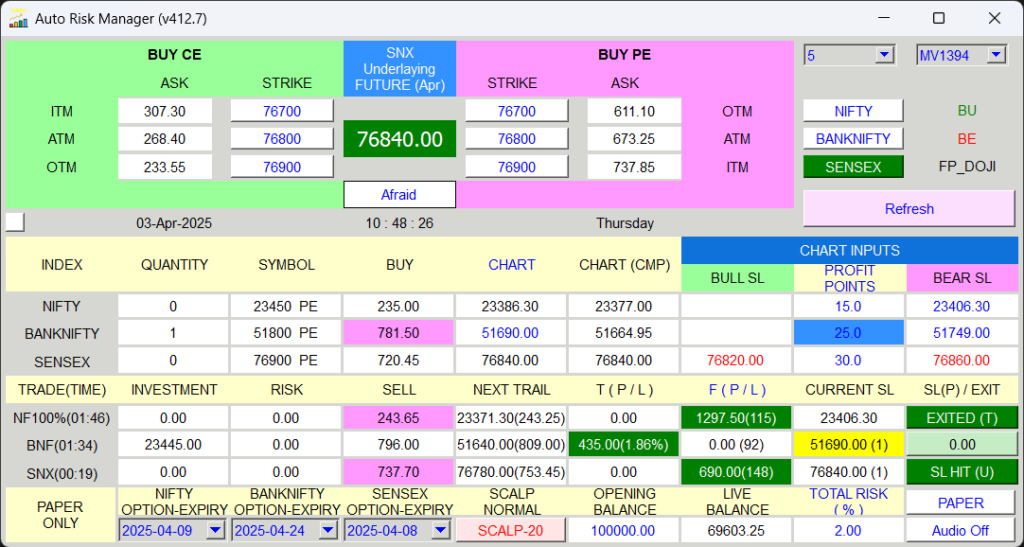

- Once trade is executed ARM helps in Trailing Stoploss & Profit Booking.

- ARM Paper Trading Mode is particularly beneficial for new traders, as it provides a risk-free environment to learn and practice trading.

- ARM Paper/Real trading mode works in the Live Market, enabling beginners to gain experience effectively in Paper Mode and allowing Beginners/Experts to book Profits/Stop Losses quickly in Real Trading mode.

- Competable with Windows 8/10/11 (32-bit/64-bit) and a Zerodha Account.

- A Trader can install ARM NBFO & STK both software, but cannot use both at a time, trader can register & deregister any software at any time.

Note: Auto Risk Manager (ARM) is Not an Auto Trader, but it calculates contracts (quantity) Automatically depending on the risk decided by the trader when the trader initiates the trade.

Features of ARM

- Single Click Buying and Selling

- All orders are Limit Orders. There is No Fear of Freak trades.

- All our Buying at Ask price and Selling is at Bid price.

- You can define Risk %you want to take in the trade.

- You can Save your Default settings as well.

- You can Track Time / Duration of the trade.

- Their are 13 Diffrent Candlestick Patterns Identifyed and are Displayed.

- No need to Add Strikes, by default there are 3 Strikes i.e. ATM, ITM ad OTM. (Strike Diffrence can be selected)

- You can trade and track 3 different trades simultaneously, one for NIFTY, one for BANKNIFTY, and one for SENSEX.

- You can take Normal/Scalping Trades in all NIFTY,BANKNIFTY, SENSEX Indices.

- In PAPER ONLY mode you can add dummy balances and get experience just like real trading.

- Their are 4 different user selectable Profit Booking Stratagies, like 20%, 33%, 50%,100% on Initial Quantity.

You can record your Emotional state before taking a position, which will be saved in the Trade Log file for further analysis.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing”

Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

“The securities quoted are for illustration only and are not recommendatory”

*Terms and Conditions Applied.